Terra’s CentroCity at 3825 Northwest Seventh Street in Miami; the Embassy Lakes Shopping Center at 2661 North Hiatus Road in Cooper City and Delray Square at 4771 West Atlantic Avenue in Delray Beach (Google Maps)

Retail rents continued to creep up in the last quarter of 2021, as the vacancy rate dipped below 5 percent across South Florida, according to a recently released report.

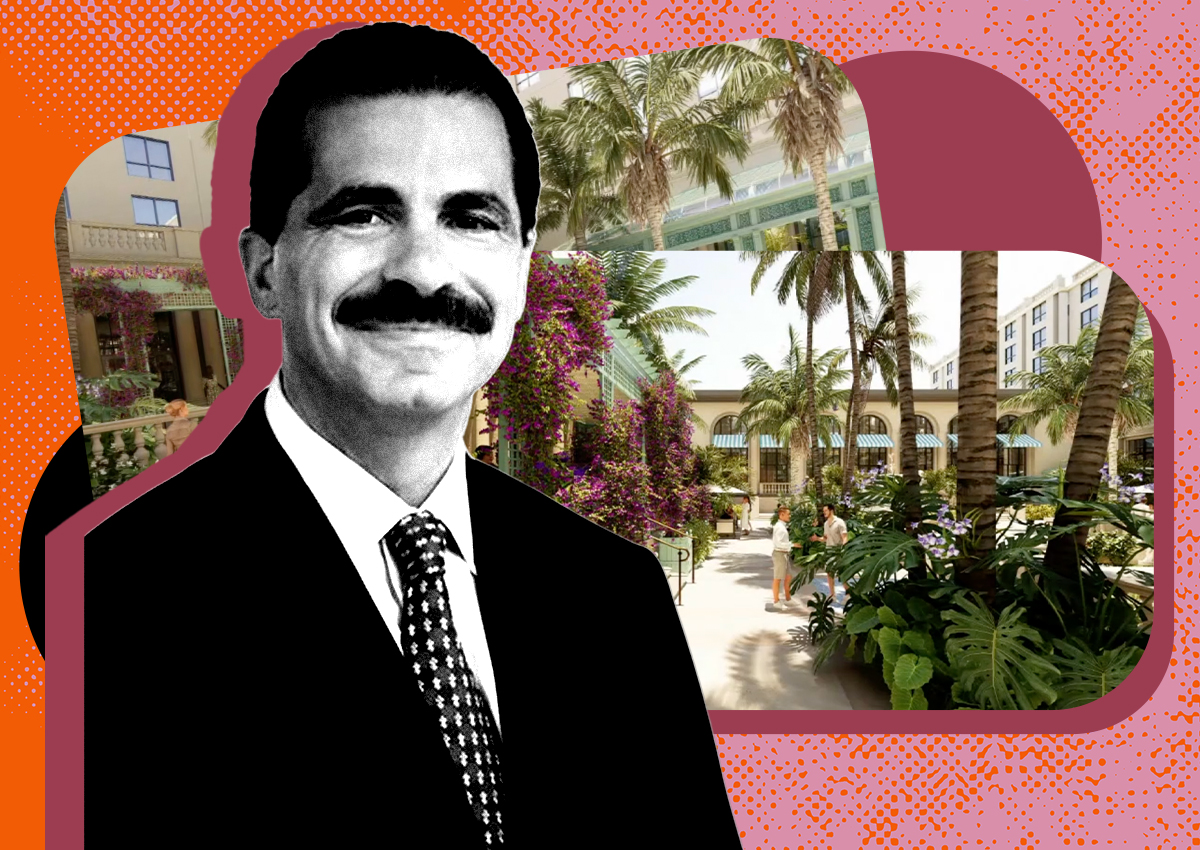

Dave Preston of Colliers, which authored the report, told The Real Deal that landlords across the tri-county region are seeing high occupancy, boosting their confidence to keep rental rates on an upward trajectory.

“In Miami-Dade, the market is starting to get tighter,” Preston said. “It loosens up a bit as you get further north to Palm Beach.”

Trends in the South Florida retail market include the return of large fitness gyms, Preston said. “A lot of businesses that were expanding before Covid are coming back full force, such as health clubs,” he said. “Health clubs had pulled back and shut down expansions in the past couple of years. Now they are getting aggressive again.”

Restaurants are having a harder time finding fully built out spaces, forcing their owners to seek unfinished spaces in new projects, Preston added.

“Overall, we continue to see positive momentum in the retail market,” Preston said. “It’s pretty much like this across the board. Even in Palm Beach [County], where we traditionally see more spaces available and lower rental rates, we are seeing a tightening [supply] for premium spaces.”

Miami-Dade County

The vacancy rate dipped to 3.7 percent in the most recent quarter, compared to 4.4 percent during the same period of 2020, according to the report. Net absorption jumped to 1.3 million square feet in 2021, compared to 968,000 square feet the previous year.

Landlords raised the average asking rent from $38.97 a square foot in the third quarter of 2021 to $39.49 a square foot in the most recent quarter, the report states. In the fourth quarter of 2020, the average asking rent was $36.01 a square foot.

In 2021, Target signed the biggest lease in Miami-Dade, which also represented the largest lease in all of South Florida. The national discount retailer inked a deal for 77,000 square feet at CentroCity, a mixed-use project Terra is developing near Magic City Casino in Miami.

Broward County

The vacancy rate fell from 5.8 percent in the fourth quarter of 2020 to 4.9 percent during the most recent quarter, the report states. Broward had the biggest bounceback in leasing activity. The market absorbed 1 million square feet in 2021’s fourth quarter, compared to a negative absorption of 778,344 square feet during the same period the previous year.

Tenants paid an average asking rent of $24.32 a square foot in the most recent quarter, compared to $23.04 a square foot in the third quarter of 2021. The average asking rent was $21.91 a square foot in the fourth quarter of 2020.

Bravo Flamingo Supermarket inked the largest lease in Broward last year, signing a 46,328-square-foot lease at the Embassy Lakes Shopping Center in Cooper City. The plaza is owned by Kimco Realty, which partnered with Blackstone last year to acquire a portfolio of five South Florida shopping centers for $426.8 million.

Palm Beach County

In the most recent quarter, the vacancy rate slid to 4.9 percent, compared to 5.2 percent during the same period of 2020, the report shows. Palm Beach County had a net absorption of 655,173 square feet of retail space in 2021, compared to a negative absorption of 80,513 square feet the previous year.

The average asking rent in the fourth quarter of 2021 was $27.02 a square foot, compared to $25.12 a square foot in the third quarter. In the fourth quarter of 2020, the average asking rent was $23.44 a square foot.

Palm Beach County had the second largest retail lease in South Florida last year. Hobby Lobby signed a deal for 51,727 square feet at the Delray Square shopping plaza in Delray Beach, owned by The Keith Corporation.