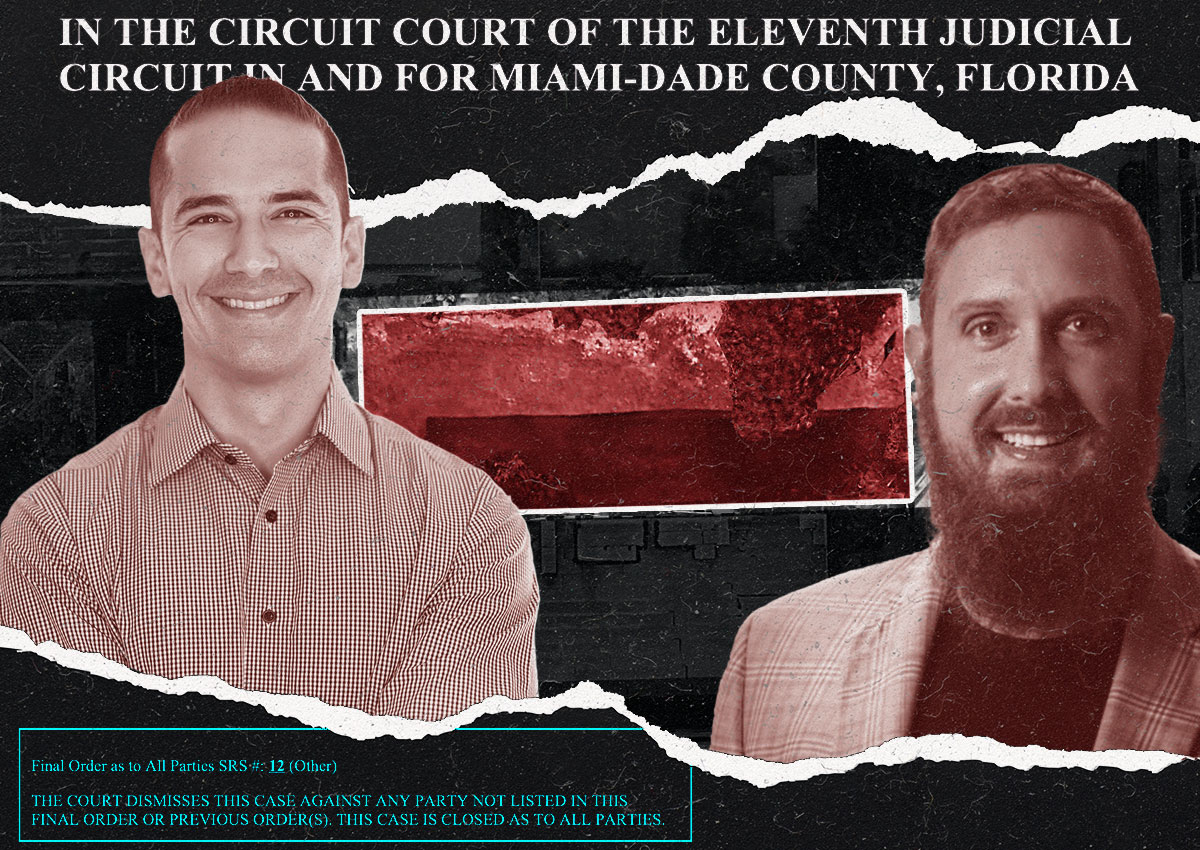

A judge hit Adam Hendry, CEO of multifamily real estate firm Tzadik Management, and affiliated entities with a $10.6 million final judgment tied to sales of apartment portfolios across the U.S.

The outcome marks the latest in the dispute between Hendry and his former business partner Alex Arguelles, a Tzadik co-founder. The pair built Tzadik into a prolific investor with a nationwide multifamily empire. But their relationship soured during the past four years, with Arguelles claiming in court that Hendry and Tzadik affiliates withheld from him millions of dollars from property deals.

Miami-Dade Circuit Judge Thomas Rebull last week issued the award in favor of Arguelles and his Gatoralex Consulting firm, and against Hendry and 19 entities Tzadik used to own apartment complexes.

Hendry, Arguelles and David Runyon founded Hollywood-based Tzadik in 2007. Runyon, a former chief visionary officer, is no longer tied to the firm and isn’t named in the litigation. Arguelles, who parted ways with Tzadik in 2019, served as chief investment officer.

In March, Arguelles sued Hendry and the 19 limited liability companies, asking the court to enforce an $8.9 million arbitration award plus interest, granted in his favor by the American Arbitration Association. The award consisted of nearly $8 million from the multifamily sales and $927,205 in attorney fees and costs.

The suit and arbitration award stemmed from a 2020 settlement agreement between Arguelles and Hendry. Arguelles had transferred his interest in the multifamily properties to Hendry. Under the settlement, Hendry and the Tzadik affiliates had to pay Arguelles a lump sum of $100,000 and then disbursements from the property sales, according to court records.

The initial $100,000 was paid, but even after the arbitration award, Arguelles hadn’t been paid “even a single dime,” according to his lawsuit.

The entire portfolio spans nearly 7,000 units, mostly in Florida and also in Texas, Georgia and South Dakota.

Rebull’s final judgment of $10.6 million is higher than the $8.9 million arbitration award because of “legal interest,” a rate set by state statute, according to Raul Morales, Arguelles’ attorney. Rebull set a daily interest of $2,771 on top of the final judgment.

“This victory reinforces the importance of integrity in business partnerships,” Arguelles said in a statement, calling the litigation “a long and difficult four-year battle.”

Arbitration included the issue of when Arguelles was to be paid. Hendry testified that it was after litigation and other costs. But the panel of three arbitrators disagreed, writing that the settlement said he was to be paid “within 10 days of disbursement of all sale proceeds.”

Hendry and the 19 Tzadik entities raised their own accusations against Arguelles in a motion to vacate the arbitration award. Hendry and the Tzadik affiliates argued that the disbursements to Arguelles were negotiated before the pandemic when it was believed the portfolio would sell for a total of $216.3 million, according to the motion. But it actually sold for $150 million.

“Mr. Hendry made money and made profit out of every sale of every portfolio that is contemplated in the settlement agreement, and he paid every other investor in the deals except my client,” Morales said. “There’s no valid explanation for that.”

Hendry and his attorneys didn’t immediately return requests for comment.