TALLAHASSEE – Suppliers hope Floridians will inventory up on storm provides all through an impending sales-tax “holiday getaway,” especially as the significantly energetic hurricane time could deliver a storm towards the condition by the conclusion of next week.

The state’s 2nd “disaster preparedness” tax vacation of the year will commence Saturday and continue on via Sept. 8.

The tax vacation arrives as the National Hurricane Middle is checking a climate disturbance anticipated to shift into the northwestern Caribbean this weekend and the eastern Gulf of Mexico up coming week.

“Possibly in June, hurricanes were not so significantly on everybody’s brain. Obviously, the tropics have lit up over the previous number of months and men and women are anxious about hurricanes,” Florida Retail Federation President Scott Shalley stated. “I think it (the tax holiday) is a good option to get out, get geared up, and save some cash as we enter the heart of the hurricane year.”

This is the initial yr the condition has held two catastrophe-preparedness tax vacations. The first period was from May perhaps 27 to June 9, about the June 1 begin of the hurricane time. Condition economists have projected the two durations will conserve shoppers $143.8 million in product sales taxes.

Florida lawmakers this spring handed a broad-ranging tax monthly bill (HB 7063) that bundled a collection of tax holiday seasons. That included a 3-thirty day period holiday, dubbed “Flexibility Summer season,” which has provided product sales-tax exemptions on recreation and outdoor objects and leisure events. The Flexibility Summer season vacation will close Sept. 4.

Examples of the Freedom Summer tax-free things involve kid’s athletic tools that expenses $100 or much less, kayaks that cost $500 or a lot less and tickets to live shows and sporting occasions.

State economists projected the Independence Summertime getaway would direct to $229.9 million in tax price savings. But Shalley mentioned much more promotion may be required if the holiday getaway is revived in the long run.

“We do not have data again however on the summer holiday, but I consider it has fallen a small bit flat,” Shalley mentioned. “We surely have place for advancement, with regard to having information out there, educating the buyer and educating the retailer. It can be a tremendous perfectly-meant holiday break. It has some good, expansive conserving opportunities.”

In the meantime, a seven-working day “device time” tax holiday break will get started Sept. 2 to coincide with the Labor Working day weekend and offer you revenue-tax exemptions on a variety of items, this kind of as instruments and perform boots. The instrument-time vacation is predicted to final result in $15.4 million in cost savings.

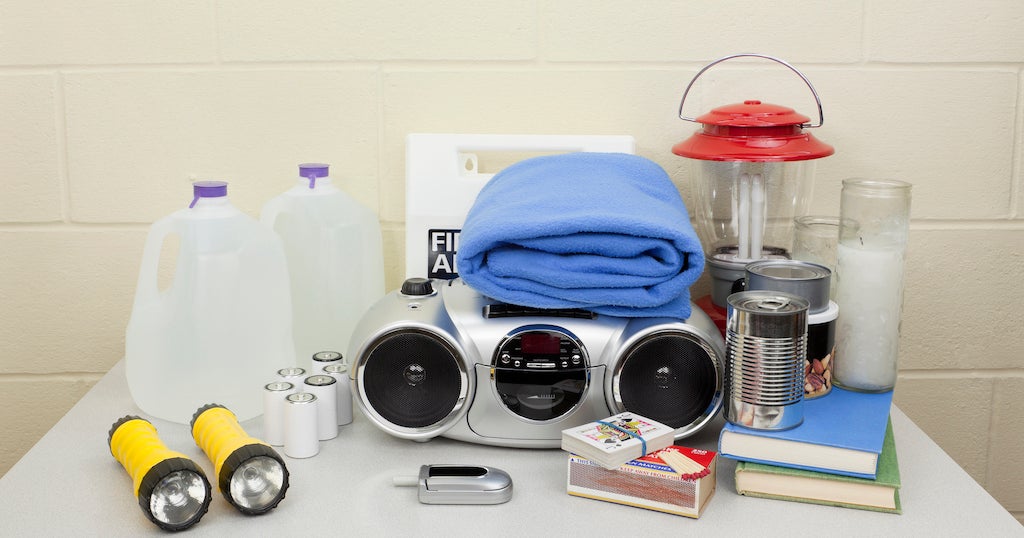

For the duration of the catastrophe-preparedness holiday break, below are some examples of objects that will be tax free of charge:

- Ice packs that value $20 or considerably less

- Batteries that value $50 or considerably less

- Non-electric meals coolers that price tag $60 or a lot less

- Carbon monoxide detectors that price $70 or much less

- Tarpaulins that cost $100 or significantly less

- Moveable generators that price tag $3,000 or significantly less

In the course of the resource-time tax holiday break – with its name borrowed from the 1990s sitcom “Property Enhancement” – right here are some examples of merchandise that will be tax free:

- Perform gloves that charge $25 or much less

- Hand tools and safety eyeglasses that price $50 or significantly less

- Device packing containers that value $75 or fewer

- Tool belts and difficult hats that cost $100 or fewer

- Work boots that charge $175 or fewer

- Power instruments that charge $300 or less

Total lists of things that are tax no cost throughout the holidays can be located on the internet In this article.