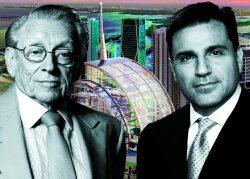

Developer Dan Kodsi’s Royal Palm Companies filed a counterclaim to its lender’s foreclosure lawsuit, tied to the stalled Legacy Hotel & Residences project at Miami Worldcenter.

Legacy Lender Holdings LLC last week sued affiliates of Kodsi’s Miami-based Royal Palm Companies, alleging that the developer owed $31.9 million in unpaid debt backing the partially built mixed-use condo and hotel tower at 942 Northeast First Avenue in downtown Miami.

New York-based Monarch Alternative Capital took over the loan from Larry Silverstein’s Silverstein Capital Partners on June 6, according to the lawsuit recorded in Miami-Dade Circuit Court. It alleges that Royal Palm failed to pay its lender, including monthly debt service payments, in May and June.

The Monarch affiliate is seeking $67.5 million, which includes fees, interest and a $32.3 million return differential, the developer’s counterclaim alleges. The return differential is “premised on the lender funding the full $290 million note” and is due in June of next year, the developer alleges.

The building is expected to have 310 short-term rental-friendly condos, a 219-key hotel and a Blue Zones medical and wellness center. Kodsi launched condo sales in 2019, and the condo portion sold out during the pandemic for an estimated $160 million, The Real Deal previously reported.

Construction of the planned 50-story tower began in 2021, and it was expected to be completed last year. But construction stalled in March 2024 as a result of a design issue, Kodsi previously said.

Construction costs have skyrocketed since the pandemic, and some condo developers have had to raise unit prices, reconfigure their unit mix to adapt, or bring on new equity partners.

Contractors, subcontractors and other companies working on the Legacy project have filed a dozen lawsuits against Royal Palm affiliates since 2023. Among them is one filed by the previous general contractor, Moss & Associates.

Monarch is a partner in Royal Palm’s Coco Beach development. The developer alleges that Monarch “committed serious misconduct, including an alleged fraudulent misrepresentation, bank fraud and civil conspiracy — all in an effort to ‘wipe out the equity’ of Royal Palm’s Coco Beach affiliate,” according to the filing, which refers to Monarch as a predatory lender.

Royal Palm affiliates have over $140 million in equity in the Legacy Miami Worldcenter project, Kodsi said.

The counterclaim, filed on Sunday, alleges that Monarch was forced to back down from the Coco Beach battle, shifting its attention to Legacy.

Silverstein Capital Partners provided the developer with $340 million in construction financing for Legacy in late 2021. At the time, it was the third largest construction loan ever in Florida. But Silverstein only funded a portion of the loan, “citing challenges from unrelated troubled projects,” which led to construction stalling, according to the developer’s counterclaim.

Silverstein’s financing included a $290 million senior loan and $50 million in mezzanine debt. Silverstein pulled a $60 million term sheet after it declared the project out of balance.

Royal Palm alleges that Silverstein and Monarch conspired to transfer the loan without giving the developer “a meaningful chance to refinance the debt.”

“Monarch’s acquisition of the note and mortgage was not about making a prudent investment,” according to the counterclaim, “but about financial sabotage.”

The building is part of the 27-acre, $6 billion mixed-use Miami Worldcenter development. Miami Worldcenter Associates, a joint venture led by CIM Group, Art Falcone and Nitin Motwani, is the master developer of the master-planned project and has sold sites to other developers. Kodsi’s Royal Palm also developed Paramount Miami Worldcenter, a condo tower, which was completed in 2019.

Kodsi said he didn’t sue Silverstein when it stopped funding the loan because “we felt we wouldn’t be able to attract other lenders” adding that, “I felt I was doing the right thing by not suing them.”

Read more

Development

South Florida

Construction at Dan Kodsi’s Legacy Miami Worldcenter still on hold

Miami Worldcenter developer nabs $340M financing for mixed-use tower, marking third largest construction loan ever in Florida