In the past 12 months, South Florida’s 10 biggest industrial sales totaled a combined $1.1 billion, eclipsing last year’s priciest deals by nearly $300 million.

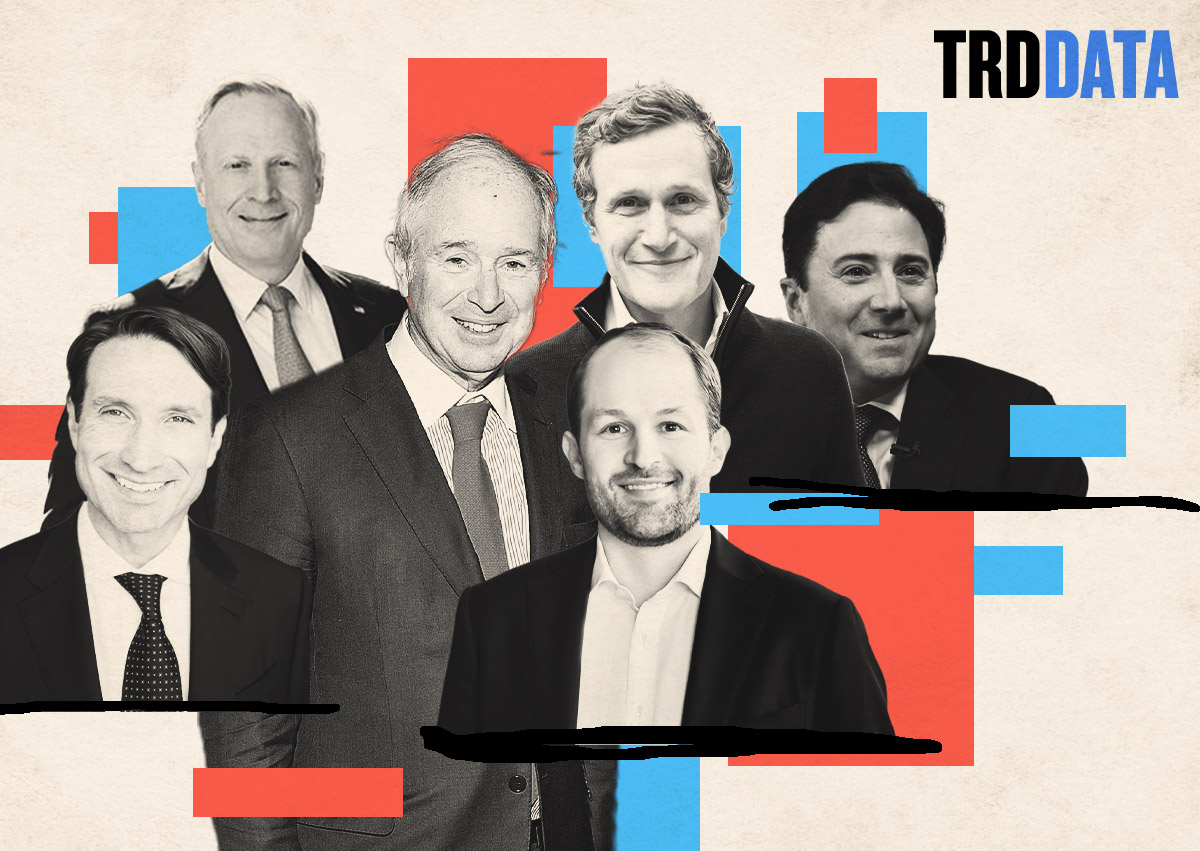

Link Logistics, the industrial subsidiary of New York-based Blackstone, took advantage of institutional investors’ industrial appetite, selling this year’s top two deals, a pair of warehouse portfolios for more than a half-billion dollars. Link is led by Luke Petherbridge, and Blackstone is led by Steven Schwarzman.

Across the tri-county region, the top 10 buyers acquired roughly 5 million square feet of industrial space this year, paying an average of $252 a square foot.

Here are the biggest industrial sales for 2024, based on data provided by Colliers and Cushman & Wakefield:

For the second straight year, Longpoint Realty Partners notched the largest industrial purchase in South Florida. Led by CEO Dwight Angelini, Boston-based Longpoint paid Link $331.3 million last month for 10 industrial sites with 26 warehouses in Coconut Creek, Dania Beach, Delray Beach, Hollywood, Miami Gardens and Miami Lakes. That’s $71 million above the $260 million Longpoint paid for 25 warehouses in Miami-Dade and Broward Counties in last year’s top industrial deal.

Shortly after the deal with Longpoint, Link sold a five-warehouse portfolio in Sunrise this month to Miami-based Elion Partners for $205.5 million, roughly $44 million more than last year’s second priciest industrial deal, which also involved Blackstone’s subsidiary. Link paid $162 million for a seven-warehouse business park in Deerfield Beach in 2023.

In October, Los Angeles-based private equity firm Ares Management scooped up Midway Miami Park for $147 million. Coconut Creek-based Butters Construction & Management and Charleston-based Greystar sold the recently completed complex of seven warehouses in Miami Lakes. Ares’ purchase surpassed last year’s third largest industrial sale by $34 million. Pontegadea, the private equity and real estate arm of Spanish billionaire Amancio Ortega, paid $113 million in 2023 for Bridge Point Cold Logistics Center, a freezer facility in Hialeah.

Ross Perot Jr., the billionaire son of the late 1992 presidential spoiler candidate Ross Perot, dived into Palm Beach County’s industrial market. In July, Perot’s Dallas-based Hillwood paid $106.5 million for a 1 million-square-foot Amazon fulfillment center in Jupiter. Seller Truist Securities developed the single-story building on 100 acres within the 945-acre Palm Beach Park of Commerce. Hillwood’s acquisition was $40.5 million more than last year’s fourth priciest industrial purchase. Harbert Management Corporation, a Birmingham, Alabama-based investment management firm, paid $66 million for a 17-acre industrial park in Lauderdale Lakes

In June, New York-based Tishman Speyer, led by CEO Rob Speyer, purchased a fully leased warehouse complex in Pompano Beach for $101.1 million. Atlanta-based IDI Logistics sold the 35-acre Rock Lake Business Center. The sale was nearly double the price of last year’s fifth largest industrial deal when Chicago-based Walton Street paid $52 million for a Miami complex of three warehouses.

Bahrain-based Investcorp and Rosemont, Illinois-based Brennan Investment Group acquired a Deerfield Beach business park for $72.3 million in January. Los Angeles County Employees Retirement Association sold Powerline Business Park, a collection of 14 warehouses. The Deerfield Beach sale was roughly $21.5 million above the sixth largest industrial deal in 2023. Last year, Prologis paid $50.8 million for an industrial business park in Medley.

In November, Truist Securities sold another South Florida industrial property. New York-based BentallGreenOak, led by co-CEOs Sonny Kalsi and John Carrafiell, and Indianapolis-based Strategic Capital Partners, led by CEO Richard Horn, paid $60 million for a Medley warehouse leased to food distribution company Quirch Foods for the next two decades. The joint venture’s acquisition is roughly $11 million more than the $48.9 million Stockbridge Capital Group paid for six Coconut Creek warehouses in last year’s seventh priciest industrial deal.

Salt Lake City, Utah-based Property Reserve acquired a warehouse within Beacon Logistics Park in Hialeah in July from Coral Gables-based Codina Partners and San Antonio-based Affinus Capital. Property Reserve, the real estate investment arm of The Church of Jesus Christ of Latter-Day Saints, paid $55.8 million, about $12.5 million above last year’s eighth largest industrial sale. In 2023, Orion Real Estate Group paid $43.3 million for a Hialeah Gardens warehouse.

Also in July, Irvine, California-based LBA Logistics purchased a Riviera Beach warehouse for $55 million from Dalfen Industrial.The deal was $12 million above 2023’s ninth highest industrial sale. Last year, Arden Logistics Parks acquired a three-warehouse complex in West Palm Beach for $43 million.

An end-user closed out the top 10 industrial deals of this year. Chik-Fil-A, led by CEO Andrew Truett Cathy, paid $50.5 million in February for a distribution facility in Weston. The Atlanta-based fast food chain’s purchase is roughly $10.7 million above the tenth priciest industrial deal of 2023. Last year, Summit Real Estate Group paid $39.8 million for a Fort Lauderdale warehouse.