Graham Companies, the family owned developer of Miami Lakes and its biggest property owner, proposes a 220-unit multifamily complex in the town.

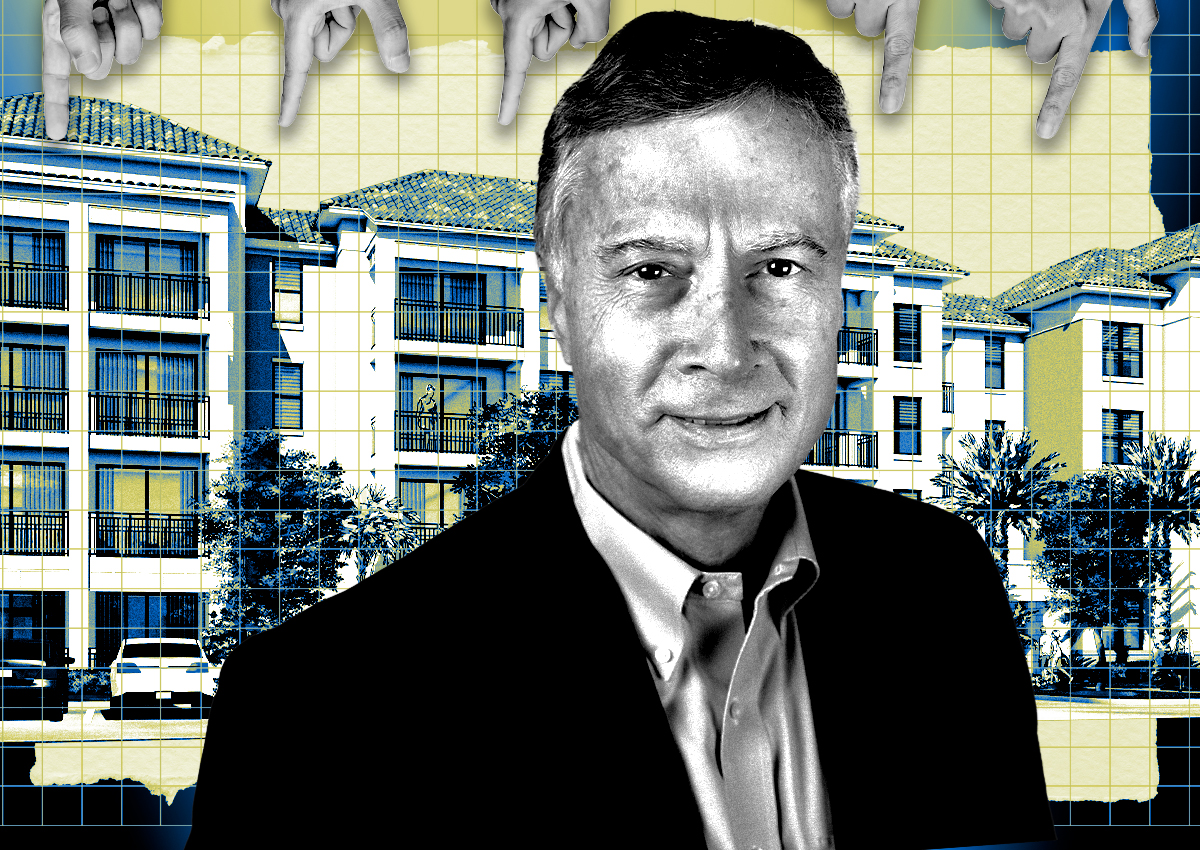

Led by CEO Stuart S. Wyllie, Graham wants to build the Lakeside project with four four-story buildings on a 9.5-acre vacant site at 14610, 14620, 14640 and 14650 Oak Lane, according to the Miami Lakes Town Council meeting agenda.

The application comes as South Florida is experiencing a surge in multifamily project proposals, leading to a record pipeline.

On Tuesday, Miami Lakes Town Council deferred voting on the project’s site plan to a future unscheduled meeting. The town’s planning administrators recommended approval of the project if Graham meets a slew of conditions, including obtaining construction permits within a year after project approval, unless it secures an extension. Also, Graham has to either donate 1.5 acres of land to the town for a park or pay a “large park” concurrency fee.

The site is within a larger Graham-owned tract that the firm had rezoned in 2017 for the development of an assisted living facility, a skilled nursing center and a 62-and-older residential complex. The recently proposed rental complex won’t be age restricted.

Graham Companies traces its roots to milk, bottling and distribution company Graham Dairy, started in 1932 by the late Ernest R. Graham. Since then, Graham’s descendants have expanded the company into real estate, including the development of the 3,000-acre master-planned Miami Lakes, according to Graham Companies’ website. Graham family members include the late Phil Graham, who was publisher and co-owner of The Washington Post, and the late Bob Graham, a politician.

Graham Companies’ portfolio includes over 2,200 apartments across 10 complexes in Miami Lakes, and more than 4.6 million square feet of industrial, office, retail and mixed-use properties, its website shows.

South Florida became a magnet for out-of-state residents from late 2020 through 2022, prompting unprecedented apartment demand and record rent increases. Developers seized on the bonanza with plans for new projects. By year-end, 23,863 units are expected to be completed across South Florida, the highest since 2002, according to Berkadia.

The multifamily market’s new supply is coming as demand from out-of-state residents has dried up. Landlords are offering concessions such as a month or two of free rent to attract tenants at recently finished projects, and rents have plateaued or decreased in some submarkets.

Developers still are pursuing project approvals, though some plan to hold off on starting construction until the new supply is absorbed and interest rates come down.

In Miami, Acre wants to build a six-story, 337-unit apartment building on the northeast corner of Biscayne Boulevard and Northeast 64th Street in the MiMo Biscayne Boulevard Historic District. In Lake Worth Beach, AvalonBay Communities dropped $16.5 million this month for the site next to the Publix-anchored shopping plaza at 374 Northlake Boulevard, with plans for a seven-story, 279-unit apartment building.