A pair of condo owners at the embattled Heron Pond complex in Pembroke Pines lost their first court fight against the receiver’s plan to list the property for sale.

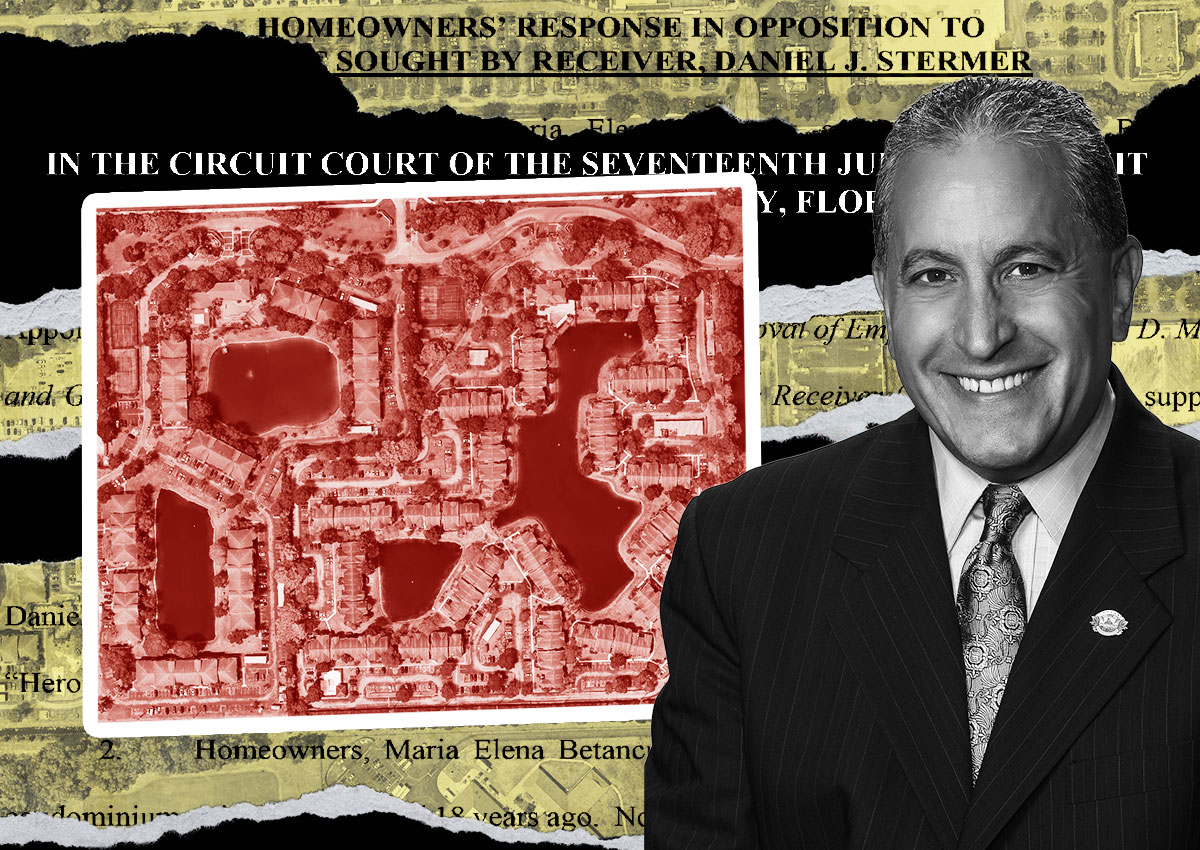

The 25-acre Heron Pond, at 8400 Southwest First Street, is home to 304 units in 19 two-story buildings. Since last summer, the city has slammed Heron Pond with multiple unsafe structure notices, rendering six buildings and 26 units in seven other buildings uninhabitable.

After Daniel Stermer was appointed receiver in April, further engineering reports showed that some of the buildings have “hidden” deficiencies to the lateral load resistance, leading to the evacuation of all remaining residents late last month. Stermer now wants to set the stage for a marketing process.

Unit owners Maria Elena Betancur and Gloria Patricia Betancur opposed the receiver’s motion to hire Greenspoon Marder attorney Dennis Mele as special counsel during a court hearing on Wednesday. They also opposed hiring Condominium Advisory Group to help with the termination of the association. Mele would provide an analysis of the Heron Pond’s redevelopment potential in a push to raise the sale price.

The Betancurs take issue with the costs of the receivership, including the additional hiring of advisers to the sale, as well as with some of Stermer’s decisions so far. Homeowners now face higher costs to relocate and the potential loss of their equity in Heron Pond units, all while the association’s funds are bankrolling the receivership, the Betancurs’ attorney wrote in their motion.

Judge Jack Tuter Jr. sided with Stermer, and capped Greenspoon Marder’s rate at $600 per hour, less than Mele’s hourly rate of $775.

“These homeowners were under the impression that when the receiver was appointed, that he would be able to come in and perhaps find a way to rehab these properties,” said the Betancurs’ attorney, Elizabeth Perez. “Instead, in short time now, these homeowners are left looking for a new place to live, higher prices and paying expenses out of their pocket.”

The Betancurs paid $201,900 for their 1,033-square-foot unit in 2007, records show.

Tuter said he was limited in what he could do. “What is your solution? Let’s just sit there and do nothing and just let the properties fall in further decline?” he told Perez during Wednesday’s hearing. “Your issues are with the city. They’re not with the receiver. It’s the signal that everybody should leave the premises.”

Brian Rich, an attorney for the receiver, said Condominium Advisory’s contract is set at $3,000 a month and can be canceled with a 30-day notice.

Perez said after the hearing that her clients are “contemplating all the legal options available to them, one of which would potentially be a lawsuit against the association.” But such litigation is stayed until the judge rules otherwise, according to his motion appointing Stermer receiver.

The deadly Surfside condo collapse in 2021 put a spotlight on older buildings and associations’ deferred maintenance and repairs. New state laws passed in 2022 and 2023 create milestone inspections for condo buildings of a certain height and age, and require structural integrity reserve studies every 10 years, among other requirements. Many associations were previously able to waive the full funding of their reserves, so condo buildings across the state are struggling to catch up.

The plan to sell Heron Pond, originally built in 1988 as apartments and converted to condos in 2006, marks the latest chapter in the complex’s long-running saga, which includes accusations against former board members of purposeful mismanagement.

In their motion, the Betancurs bring up claims similar to those made by other unit owners in past court filings. Namely, some unit owners have pointed a finger at one secretive entity: Federated Foundation Trust. It amassed 111 units, making it the majority unit owner, which previously allowed people tied to the trust to take board seats. The primary person tied to the trust is former board member Piyush Viradia, who has used the alias Peter Patel, according to residents’ court filings.

“Patel was chiefly responsible for mismanaging, misappropriating and most likely embezzling association funds to benefit himself and his trust,” the Betancurs say in their motion.

In his April petition to appoint a receiver, unit owner James Rhodes alleged that people tied to Federated “may have wanted” Heron Pond to fall into disrepair, which would allow them to buy more units at a discount.

Stermer’s decision to sell Heron Pond could pave the path for Federated to do just that, the Betancurs wrote in their motion.

“Clearing out all homeowners of the association essentially now provides an opportunity for the very wrongdoers who ran the association into the ground in the first place while enriching themselves with the association’s funds, i.e. Patel and Federated Foundation Trust, to purchase the Heron Pond property for pennies on the dollar,” the Betancurs wrote in their court filings.

The receiver’s “goal has been to take the easy way out” by selling Heron Pond, they wrote. Instead, he should have been doing a historical accounting of allegedly misappropriated funds and investigating Patel/Viradia.

Stermer disagreed with these allegations, arguing that his primary focus so far is residents’ safety and the structural condition of the buildings.

“Issues such as what happened in the past, we are going to get to,” he told The Real Deal. “The unit owners believe what they believe. At the moment, I can’t say whether it’s correct or incorrect.”

Keith Grumer, an attorney for Federated Foundation Trust, denied allegations against the trust. He called some of the claims in Betancurs’ motion “slanderous” and said the filing lays out no supporting evidence.

“If Federated owns, let’s just call it 35 percent of the units, Federated would be stealing from itself. That’s absurdity. They have paid like $50,000 a month in condo dues,” he said.

The Betancurs’ filing only impedes the sale, leading to higher costs for homeowners. “The sooner the property is sold and money is distributed, the sooner all the bleeding stops,” Grumer said.

In a non-binding poll by the receiver, 86 percent of those who voted agreed to a sale. Owners representing 80 percent of the units participated in the poll. Federated Foundation voted in favor of a sale, according to Stermer’s report.

A special assessment for needed repairs would break down to at least $40,000 per unit, he wrote in his report.

The Betancurs wrote in their filing that Stermer is presenting a “false dichotomy” between selling or paying at least $40,000, arguing that another engineering report contradicts some of the findings in the receiver’s engineer’s report regarding the extent of disrepair. Perez, the Betancurs’ attorney, called it “fear mongering” to only present those two options to homeowners.

“Unfortunately, they may not really understand they can question and appeal the decisions being made by the receiver,” Perez said. Stermer could have tried to recoup allegedly misappropriated funds by ex-board members or sought lower bids for repairs, according to the Betancurs’ court filing.

The complete evacuation came after ACG Engineering Services’ July report that determined lateral load resistance deficiencies in some of the buildings undergoing repairs, due to inadequate design and construction. Because they are embedded in the “bones” of buildings and can’t be seen, ACG recommended the complete evacuation at least until hurricane season ends or repairs are completed.

Exactly how funds from a sale will be divided among unit owners hasn’t been decided, Stermer said.

In his report to the court filed last month, Stermer pointed out a state law that says that if the disbursement to a homeowner is less than the outstanding mortgage balance on a condo unit, the lender has to accept the homeowner’s proceeds as satisfying the mortgage. This means unit owners won’t be on the hook for more than they receive to pay off their mortgage, but they also won’t make a profit.

The Betancurs’ opposition to Stermer’s decision isn’t the first time homeowners at an association embroiled in allegations of mismanagement take issue with their court-appointed receiver. At West Kendall’s Hammocks, one of Florida’s biggest homeowner associations, some residents pushed back on the receiver’s costs and administration of property affairs. David Gersten took over as receiver after four former Hammocks board members and the husband of an ex-HOA president were arrested in 2022 over allegedly running a massive multi-million dollar fraud.

The judge in the Hammocks case has largely sided with Gersten, telling homeowners at hearings that a receivership is costly but needed to set the HOA in the right path. Last month, the judge approved Gersten’s motion to step back as receiver and remain monitor of Hammocks’ affairs.

Read more

Residential

South Florida

“Becoming a big issue”: Conflicts at condo, homeowners associations fuel insurance woes

Residential

South Florida

Hammocks guide: Inside embattled HOA’s affairs since ex-board members’ arrests

“Running amok”: Florida lawmakers fall short with HOA, condo law