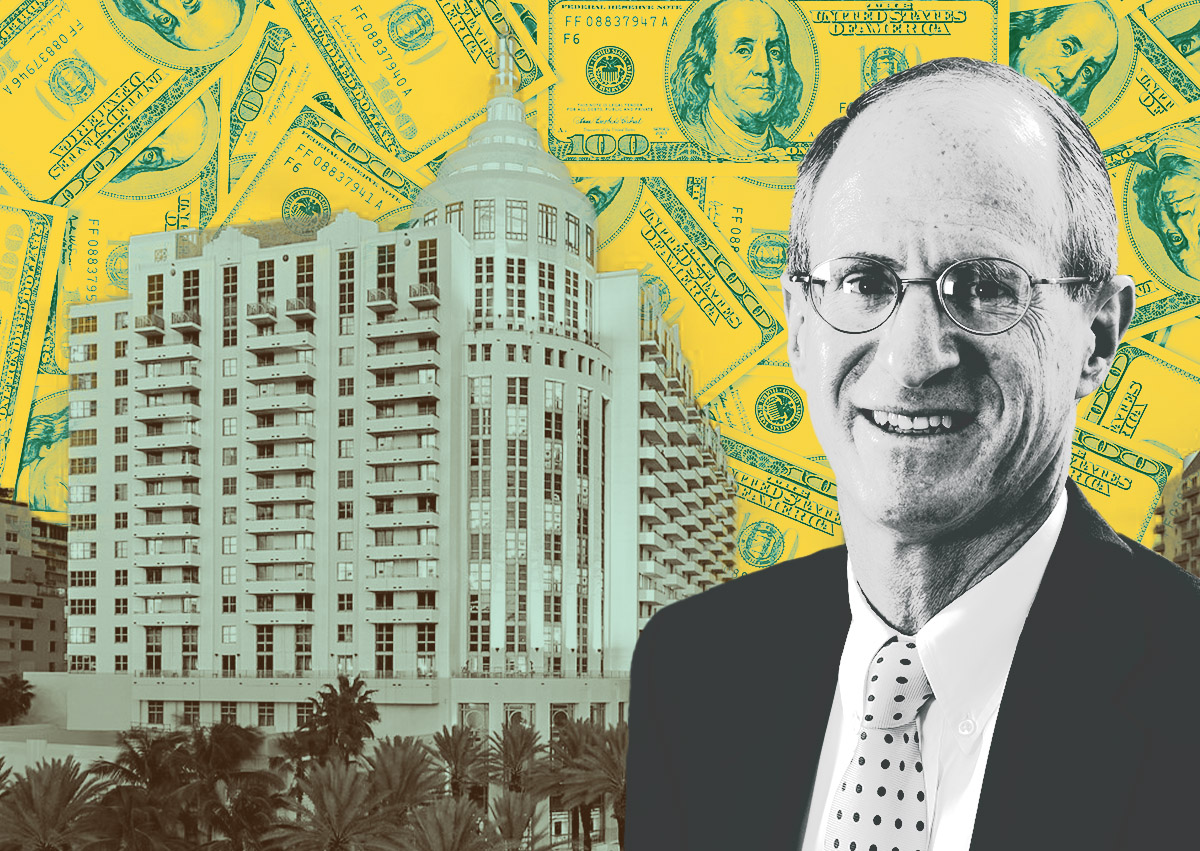

Loews Corporation is getting a $305 million refinancing of the loan backing its oceanfront Miami Beach resort.

The financing is for the 5-acre, 790-key hotel at 1601 Collins Avenue in Miami Beach. Wells Fargo, National Association and JPMorgan Chase Bank are originating the loan, according to Fitch Ratings. It’s expected to close on Sept. 10.

A spokesperson for Loews did not respond to a request for comment.

The 10-year, fixed-rate and interest-only loan will refinance the existing debt of $300 million and cover closing costs of about $5 million, according to Fitch.

Loews, led by the billionaire Tisch family, acquired the two-tower property in 1998. It includes the historic St. Moritz building and the 17-story tower next door, as well as about 46,000 square feet of meeting space, six food and beverage outlets, retail space, a pool and cabanas. Rao’s operates a restaurant at the property.

Fitch states that with a loan-to-value ratio of 74 percent, the property is valued at just over $400 million, or about $507,000 per key.

Earlier this month, BDT & MSD — a merchant bank formed through a merger between Trott’s BDT & Company and MSD Partners, the private investment arm of Dell Technologies founder Michael Dell — secured a $1 billion refinancing of Boca Raton Resort & Club. The 1,047-key luxury hotel is at 501 East Camino Real in Boca Raton. Citi Real Estate Funding provided the two-year, floating-rate interest-only loan.

Read more

Price revealed: Billionaire Larry Ellison dropped $277M for Eau Palm Beach Resort in Manalapan

Iconic NYC eatery Rao’s to open at Loews Miami Beach

CGI Merchant loses downtown Miami Gabriel hotel in UCC auction