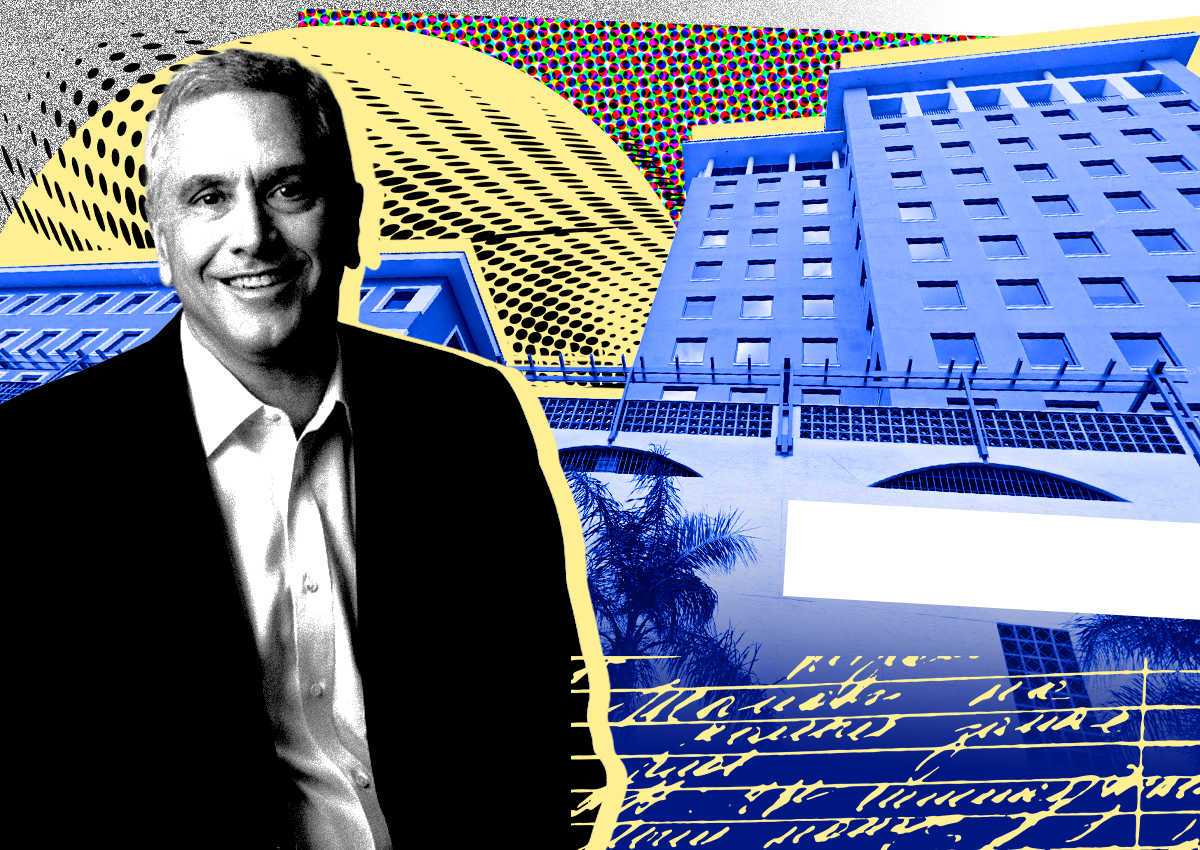

Affinius Capital may not own the Columbus Center in Coral Gables for much longer.

The lender on the office building could move forward in a deed in lieu of foreclosure, according to Morningstar Credit.

Minneapolis-based global alternative investment management firm Värde Partners is considering the workout strategy for the troubled $67.4 million loan on the property at 1 Alhambra Plaza, Morningstar Credit data shows. The loan entered special servicing in March when it became delinquent due to Affinius’ failure to secure a cap on the debt’s floating interest rate.

The San Antonio, Texas-based firm led by Len O’Donnell took out the loan for the 262,000-square-foot structure in 2021.

The special servicing designation of the loan and the possibility of a deed in lieu of foreclosure is the latest sign of South Florida office market distress.

After a flurry of new-to-market company leases over the past four years, the real estate industry was abuzz over South Florida’s resilience to office real estate woes evident elsewhere in the U.S. But it’s become evident that the tri-county region won’t be spared from trouble due to elevated interest rates, skyrocketing insurance and remote work.

Columbus Center’s occupancy has been 62 percent this year and last. That’s down from 76 percent in 2022 and 69 percent when the loan was issued three years ago, according to Morningstar Credit.

Tenants include Apple, which leases nearly 50,000 square feet; First Horizon Bank, which has 19,400 square feet; and co-working space provider Regus, which has 17,800 square feet, Morningstar data shows.

The property’s net operating income dropped significantly from its $5.6 million high in 2021 to $3.7 million in 2022 and $3.8 million last year. The net operating income in the first quarter of this year is just over $1 million.

The debt service coverage ratio, a measure of a loan’s performance, also dropped from 1.98x in 2021 to 0.6x in the first quarter, according to Morningstar. A DSCR of 1x is generally considered the breakeven threshold for a property to generate enough income to cover expenses.

The Columbus Center loan is a commercial real estate collateralized loan obligation, or CRE CLO, meaning it comes with a floating interest rate.

These types of loans have been hit especially hard from the Federal Reserve’s 11 aggressive increases of the benchmark interest rate in 2022 and last year. To hedge against such increases, lenders often require borrowers to purchase interest rate caps on loans.

The cost of interest rate caps has skyrocketed as rates have risen. For example, a cap on a $125 million loan now could reach $3 million, where it was about $50,000 in 2020, a source told The Real Deal.

After Affinius failed to secure an interest rate cap, its loan was accelerated, putting the landlord on the hook for the entire principal balance.

The Columbus Center loan trouble is expected to be resolved in December, ahead of the debt’s January maturity, according to Morningstar.

If Affinius does lose the building through a deed in lieu of foreclosure, it would mark the first time Columbus Center has changed hands. Its predecessor, USAA Real Estate, the real estate arm of United Services Automobile Association, completed Columbus Center in 1990, according to records. Affinius is the brand name USAA Real Estate adopted last year after its acquisition of Square Mile Capital.

Read more

L+R Hotels’ $22M loan on Fort Lauderdale Marriott enters special servicing

Fortress takes back Fort Lauderdale marina, RV park in $86M deed in lieu of foreclosure

Starwood sells four office buildings in Miramar at a loss for $45M

Affinius did not return TRD’s request for comment. In a statement to the South Florida Business Journal, the company said Columbus Center is running “successfully” and is attracting tenants.

The statement also added, “Affinius recognizes the very challenging environment for commercial office, so it is working cooperatively with its lenders in order to create a satisfactory outcome for both our investors and the lender.”