MCR desires to acquire two motels with 400 keys, mixed, next to its Hilton-branded assets around Miami International Airport.

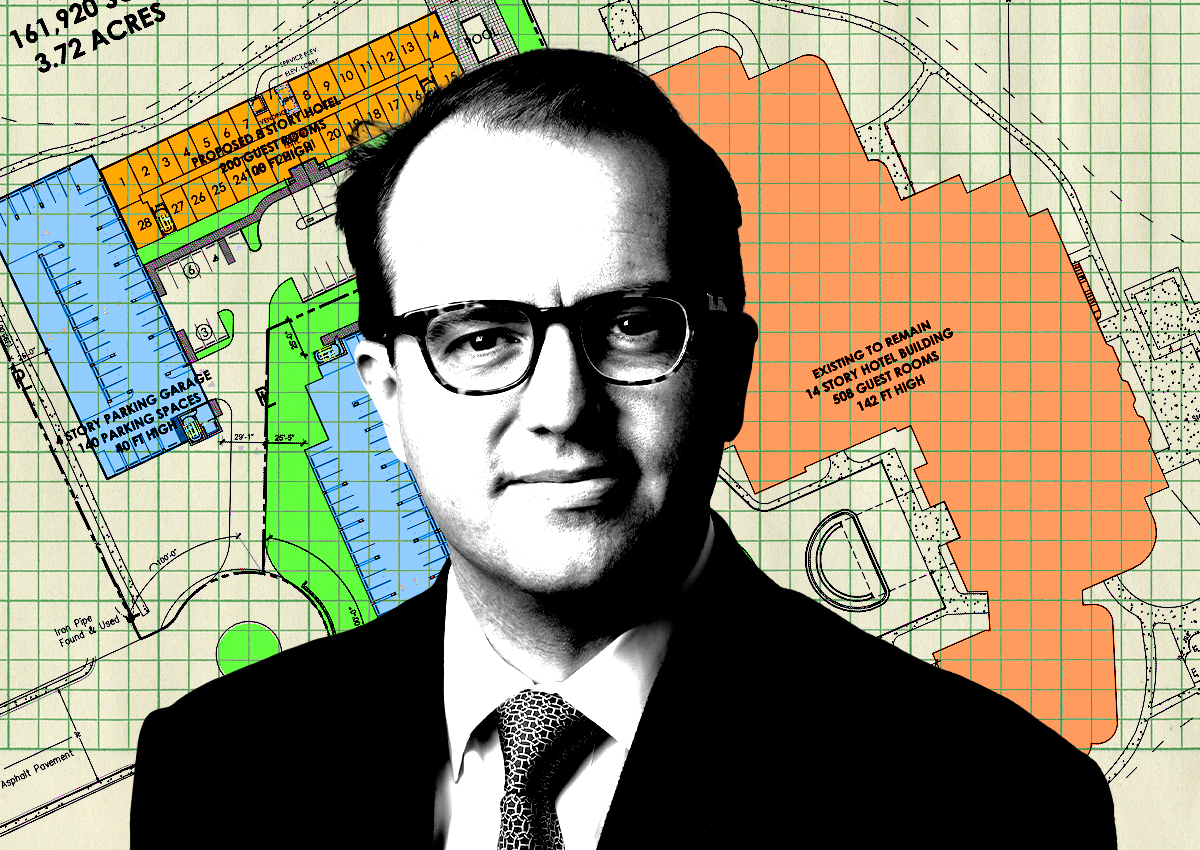

The lodge proprietor-operator proposes a pair of 8-tale accommodations, each with 200 models, adjacent to the Hilton Miami Airport Blue Lagoon at 5101 Blue Lagoon Drive in unincorporated Miami-Dade County, according to MCR’s software submitted to the county this month.

The proposal is also for a new 5-tale, 700-room garage for the Hilton, which will stay. The new hotels would increase southwest and northwest of the Hilton, and every would include a 4-tale, 140-house garage, according to the software. They would be find assistance inns, indicating they will not have a cafe or assembly room.

In the submitting, MCR cited greater demand from company vacationers for lodging in close proximity to the airport.

New York-based MCR owns the complete 20.6-acre website surrounded by a lake on 3 sides. It compensated $118.3 million for the assets, which includes the 14-tale, 508-critical Hilton on the web site, very last 12 months. Records display the acquire price was $77.8 million, however that is very likely reduce than the cost MCR declared past yr since it excludes resort furnishings and fixtures.

The web page is near the Waterford Organization District, a 3 million-sq.-foot workplace advanced that spans 250 acres near the airport.

Led by Tyler Morse, MCR is a significant resort owner and operator with a portfolio of 150 properties throughout 37 states, according to its web site. Its holdings contain the TWA Resort at JFK Airport, The Significant Line Resort in New York Town and the Pasadena Hotel & Pool in California.

In 2022, MCR scooped up the 135-key Hyatt Spot Miami Airport East at 3549 Le Jeune Street in Miami for $16.6 million, information clearly show. Its other South Florida holding is the 112-key Home Inn by Marriott at 2880 Centre Port Circle in Pompano Beach front. MCR made the Home Inn in 2015.

Examine a lot more

Miami-Dade’s lodge market has extensive bounced back again from a pandemic-induced slump, as the county a short while ago rated as the greatest-doing lodging current market in the U.S. In the week ending Feb. 24, Miami-Dade hotels’ occupancy was 88.2 p.c, the maximum among the nation’s 25 main resort markets, in accordance to CoStar.

The Miami Intercontinental Airport submarket has hosted some of the county’s financial investment income flurry. In December, petroleum distributor and actual estate investor George Nediyakalayil of Chicago dropped $29 million for the 190-place Even Resort Miami – Airport at 3499 Northwest 25th Avenue. In January, Wellesley Hills, Massachusetts-primarily based Worldwide Vision Resorts picked up the 103-critical Times Inn by Wyndham at 7250 Northwest 11th Street, also around the airport, for $17.7 million.