Very best Meridian Insurance plan Organization is seeking to nab a triple-engage in foreclosures.

In individual civil lawsuits filed in Miami-Dade and Broward counties, the Miami-based mostly financial institution is alleging the owner of a Fort Lauderdale place of work building, and a church and college owner in Miami, each and every defaulted on a mixed $11.6 million house loan personal debt.

Mitchell Mandler, Most effective Meridian’s attorney, did not answer to requests for remark.

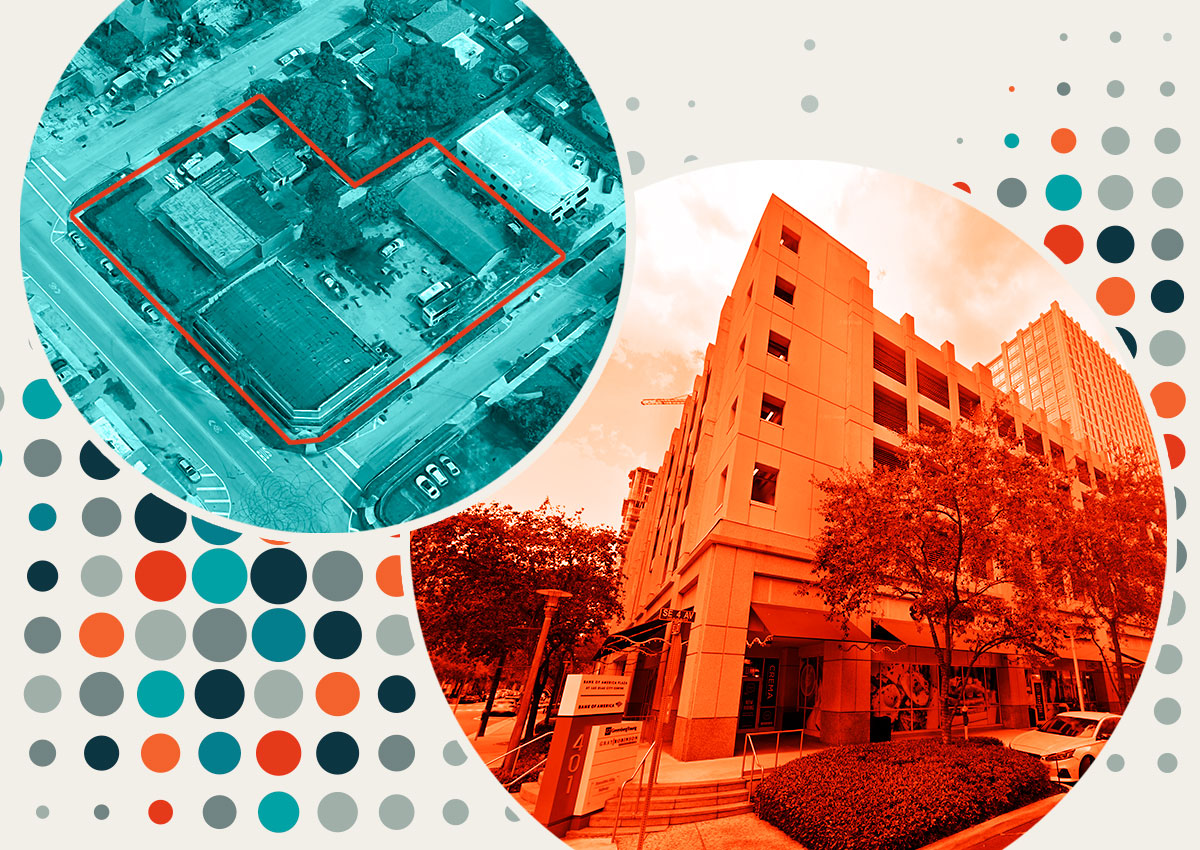

On Feb. 14, Most effective Meridian sued an entity managed by Janalie Bingham, CEO of Wells Serious Estate Financial commitment, a Boca Raton-centered company that owns Bank of The united states Economical Center at 3661 West Oakland Park Boulevard. In March, Wells acquired a $7.2 million financial loan with a 9.5 p.c fixed fascination fee from Best Meridian, but two months afterwards stopped making regular monthly payments, the lawsuit alleges.

In 2016, Wells compensated $4.4 million for the a few-tale, 43,770-sq.-foot business building done in 1976, records show. The 2.5-acre website also has 133 parking spaces.

Wells has been in search of to function out a resolution with Best Meridian, Bingham said. “We are surprised to understand they have filed for foreclosures,” Bingham stated. “We are at this time in negotiation with [Best Meridian] to resolve the concern and to fork out them off.”

On Feb. 18, Ideal Meridian sued Emy Etienne Jr., as personal loan guarantor, and an entity he manages that operates Ebenezer Christian Academy at 3925 and 3901 Northwest 2nd Avenue and Complete Gospel Assembly church at 180 Northwest 40th Street and 171 Northwest 39th Avenue. Etienne is the pastor for the church and the college, which are in Miami’s Buena Vista neighborhood.

The houses also include a 5,800-square-foot business, a 3,039-square-foot retail creating, a 1,035-square-foot residence and a 1,988-sq.-foot duplex. In June, Etienne’s entity took out a $3.9 million house loan with a 9.6 p.c curiosity level and a 4-calendar year maturity, records demonstrate,

A thirty day period later on, Etienne’s entity allegedly unsuccessful to make its regular payment, and the bank loan remains in default, the lawsuit states. In 2019, the church and the college offered the four parcels to Etienne’s entity for a blended $3.8 million. The sellers are both of those nonprofit spiritual companies managed by Etienne, even though his entity that purchased the qualities is a for-earnings firm, data demonstrate.